Rural Finance Key Interventions

.jpg)

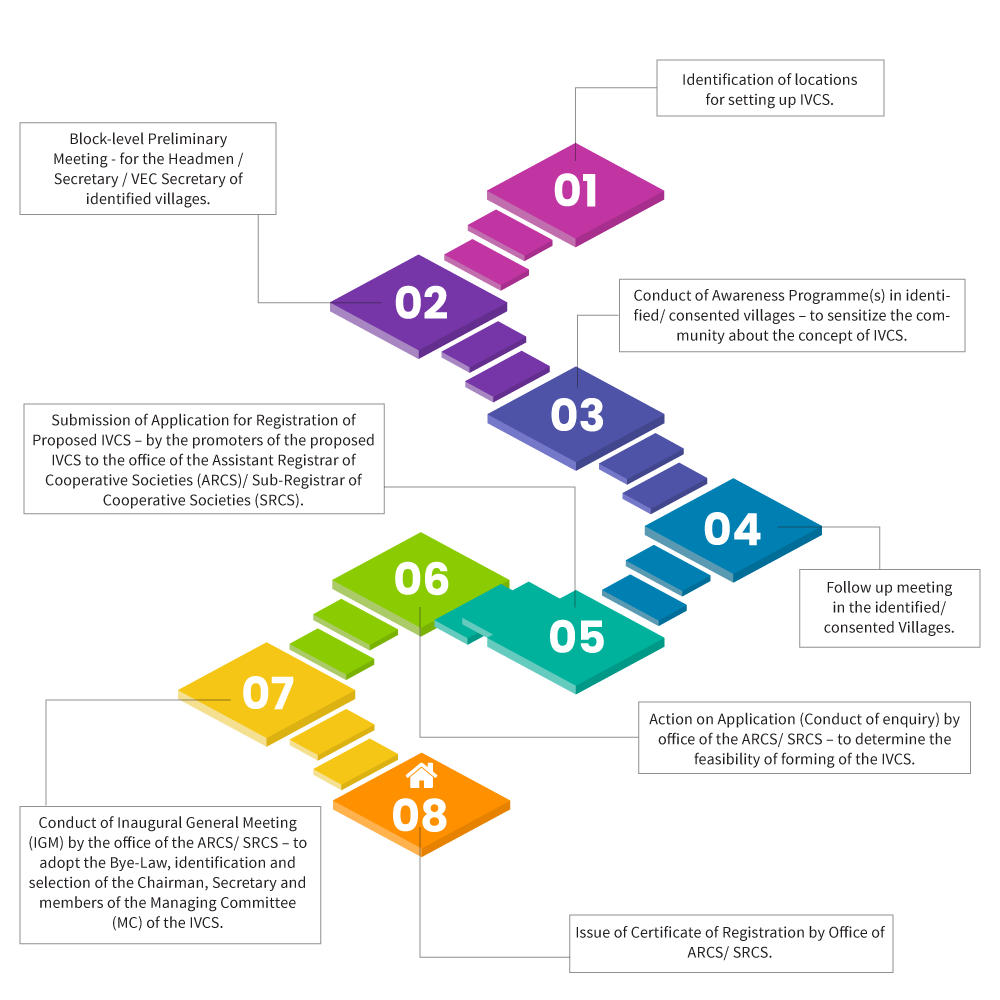

FORMATION OF IVCS

As envisioned in the project design, the ideal configuration for IVCS involves single-village cooperatives, covering approximately 200 households and having a membership of 400 individuals to ensure sustained viability. In cases where a village falls short of the specified 200 households, collaboration with neighbouring villages is recommended for IVCS formation. Each IVCS is governed by a Managing Committee led by an elected Chairman, with a mandate that at least fifty percent of the committee members be women to ensure their involvement in decision-making and representation within the IVCS. Further, each IVCS is required to abide by a model registered byelaw under the Act, which allows for amendments when necessary.

IVCS AS BANKING CORRESPONDENTS

The issue of financial inclusion in remote areas of India has long been a challenge, with many villages remaining unbanked despite efforts to extend banking services to these communities. The lack of banking infrastructure in these areas has hindered access to formal financial services for residents, limiting their ability to save, invest, and access credit. However, in Meghalaya, the IVCS have emerged to address these challenges by making such services available at the grassroots. While the IVCS have made significant strides in promoting financial inclusion in remote areas, many villages covered by them still lack access to formal banking services. To manage this issue and qualify as banked villages, they need to be connected to the interoperable core banking system (CBS) platform of banks. This can be achieved by designating IVCS as Banking Correspondents (BCs) of banks to enable them to serve as the last-mile link between formal financial institutions and rural communities.

Becoming a BC for a formal bank allows the IVCS to provide essential banking services to their members, such as account opening, deposits, withdrawals, and remittances. In addition, it enables them to offer services like Micro ATMs, which facilitate cash transactions in areas with difficult access to physical bank Assessing the Impact of the IVCS 5 branches. This arrangement not only enhances financial access for rural residents but also promotes financial literacy and inclusion by bringing formal banking services closer to their doorstep.

As of 2024, there are 200 IVCS operating as banking correspondents. Through their partnership with MCAB and other formal banks, these IVCS offer a range of financial products and services including low-interest loans, subsidy-related loans, and other benefits.

Support to IVCS

The Project envisages contribution to the IVCS as under:

CORPUS FUND

Each IVCS that achieves INR 50,000 in savings and INR 50,000 in share capital is provided with a sum of INR 2.50 lakh

EQUIPMENT & FURNITURE

INR 1.80 lakhs provided to each IVCS for procuring items required for running their offices

VIABILITY GAP FUNDING

project compensates for any loss incurred by an IVCS for up to Rs. 77,500 during a financial year

Books of Accounts, Ledgers, Registers, Pass Books, etc. are prepared, printed, and provided free of cost to all IVCS

TRAINING

Capacity-building programmes to IVCS secretaries and members of the MCs including orientation training, business development and preparation of business plans and action plans, maintenance of books of accounts and registers, and basic computer training.

FINANCIAL LITERACY PROGRAMMES

conducted in all the IVCS/villages by Financial Literacy Facilitators (FLFs)

EXPOSURE VISITS

for IVCS to the good-performing IVCS within the state and for good-performing IVCS to other States in the country

DIGITIZING THE OPERATIONS OF IVCS

In matters of rural development and navigating the challenges of the modern economic landscape, entities like the National Bank for Agriculture and Rural Development (NABARD) play an important role in supporting the trajectory of the IVCS. Recognizing the imperative for sustained growth, NABARD actively engages in comprehensive capacity-building initiatives and efforts toward computerization. To this end, the project is actively computerizing the operations of the IVCS to enhance operational efficiency, ensure accurate data management, facilitate transparent governance, and ensure sustainability.

The thrust towards computerization represents a strategic move to leverage technological advancements. The integration of digital tools is envisioned to streamline various aspects of IVCS operations. This includes adopting platforms for efficient record-keeping, financial management, and streamlined communication.

The Project envisages contribution to the IVCS as under:

IVCS AS GROWTH HUBS

In the context of ensuring a sustained quality of life for the farming communities of Meghalaya, the Megha-LAMP project strategically channels numerous initiatives through the IVCS. A significant portion of the project’s agricultural infrastructure, aimed at strengthening linkages to markets, capital, and supply chains, is managed by the IVCS via a social enterprise approach. Established by the project are Collective Marketing Centres (CMC) and Custom Hiring Centres (CHC), and in partnership with various entities such as the North Eastern Council (NEC) and the State Council of Science Technology and Environment (SCSTE), among others, are PRIME Hubs and Farmers’ Markets.

These facilities extend services that not only boost agricultural activities and price realization but also cover the costs of the economic activities of the IVCS, including operational expenses. With these assets, IVCS are no longer viewed as just cooperatives that provide essential financial services; today, they have evolved into growth hubs for farmers to access larger economic activities accountable to many other stakeholders. The rationale behind this strategy lies in the imperative to ensure that the IVCS receive and possess essential assets to enable them to sustain operations beyond the project period.